Invest+Retire – Vital to plan early – Future Proof your future You will be amazed at your options and how families can work together with Invest Retire according to the founder of SunLife Australia, Timothy Wright.

When Tim was asked about retirement decisions he said ‘many people leave key retirement decisions too late, such as where to live when downsizing or seeking a new beginning to get the most out of life’.

“They leave it until their opportunity to fully enjoy retirement and community living and community spirit is diminished,” he said.

“People need to plan early when the best financial and personal decisions can be made. SunLife Australia encourages and is focused on the opportunity to make decisions early and plan for an active and fulfilling retirement.

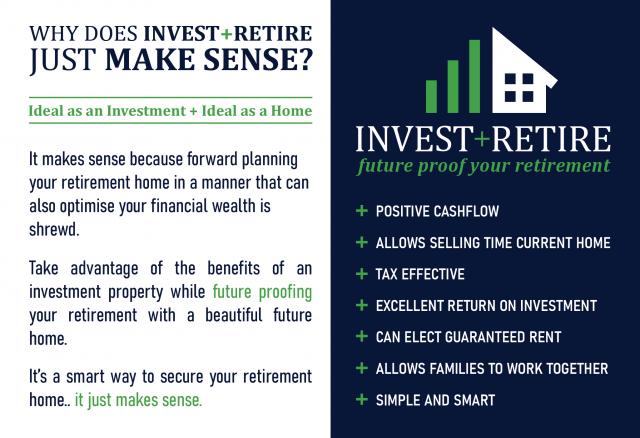

“Basically, Invest+Retire is where you purchase your retirement lifestyle property as an investment, with all the usual property investment benefits, and then move into when you are ready.

“In fact, children can purchase for their parents’. With respect to planning for a home in your senior years, the SunLife Australia Invest+Retire package can tick all the boxes.

SunLife Australia has effectively hit on a formula where strategic financial and personal planning for future retirement can be worked through in a very strategic and proactive manner.”

Tim said this is all possible with SunLife estates such as SunLife Warwick Horizons where you own the land, no lease or license involved. This is a key point of difference.

So, what is Invest+Retire all about in more detail?

“It really is very simple and can be done at any age. Just identify where you want to live in a SunLife over 50s freehold estate and purchase it as an investment property,” he said.

“Check value and amenity. Look at rentability and if there are any rental underwrites or guarantees. Take advantage of tax deprecation benefits in your own personal circumstances or in your Self Managed Super Fund (SMSF).”

Tim Wright said “with the economy as it is there is no better time to set up your financial future while you are working for your future over 55s work slowdown or retirement”.

“Most importantly, you need to consider the impediments imposed in the banking world for those who are over 65 to borrow, or who have a relatively low income,” he said.

“It is important to set all this up while you are working with a reasonable income or link up with your children who may have a good income.”

He said another important aspect is flexibility to sell your home when you want to optimise value.

For many, their home is a major asset and, accordingly, when selling it to downsize or move to an over 50s, it is important that it can be done at the most opportune time and not in a rush.

Tim said Invest+Retire allows for that, as you have identified and purchased your retirement home and it is earning an income.

“A real advantage of freehold such as at SunLife Warwick is that you can sell your property at any time and keep all the capital growth,” he said.

“There are no entry or exit fees or lock-in hurdles. A key facet of SunLife Warwick and Invest+Retire is a two-option rental arrangement; firstly, a rental underwrite, which establishes a base rent plus you keep whatever excess is received in rent, or a rental guarantee.

“This provides you with total peace of mind that your investment property is earning at all times. SunLife Australia has identified that there is a real demand for seniors who want to rent in SunLife estates and believe there are many over 55s who would love to rent at SunLife Warwick for a short or long period of time and enjoy the clean, crisp, country air and the wonderful, community spirit.

“All in all, the SunLife Warwick Invest+Retire packages are a real winner.”

Tim is a real fan of the Invest+Retire model where children and parents work together for both their financial future.

“Those 35-to-50-year-olds on good incomes who have earning income to purchase an Investment Property, but may not have the cash equity, can team up with their parents who have some cash to contribute, but don’t have an income to allow them to borrow easily,” he said.

“It’s a win-win in that the children buy the property as an investment property with some contribution or loan from the parents, and the parents then rent back the property to cover the mortgage.”

Tim went on to say that while people should seek independent financial advice as to property investment and their own circumstances, he and the Invest+Retire team have all this ‘modelled out’ and they are happy to explain Invest+Retire to you.

Learn more about Invest+Retire at www.investretire.com.au and register interest. Or register interest at www.sunlifewarwick.com.au